In New York City, a member of the Democratic Socialists of America (“DSA”) is elected as mayor. He promises to freeze rent, raise taxes on wealthy New Yorkers, and offer free… well… everything, it seems. Surveys show that some 9% of city residents would consider leaving New York under a Zohran Mamdani administration.

Earlier the same year, the great state of South Carolina (where I call home) reports the highest state GDP growth in the union. Around the same time, new data is released that shows the state boasts the third-highest rate of net inflow migration for 2023-2024, behind only Texas and North Carolina.

In Los Angeles, the city council considers a new rent stabilization ordinance. The ordinance would cap rental increases for hundreds of thousands of apartments to between 3% and 4% (depending on the classification). Ostensibly, the ordinance is designed to address the breathtaking cost of housing. But developers and landlords in the city are quick to point out that capping rental increases will only disincentivize new residential projects, thus reducing new supply. It will also lead to less capital for maintenance, leading to run-down buildings. The city council passes it anyway.

Around the same time, an editorial is published in the Las Vegas Review-Journal with the headline “California businesses are welcome in Nevada.”

In February 2025, Chicago, Illinois approves an $830 million general-obligation bond plan. Under the plan, the city will make interest-only payments for approximately 19 years. Total repayment cost over the life of the bonds is expected to be in the neighborhood of $2 billion. This at a time when the city’s net deficit for fiscal year 2026 is expected to be $1.2 billion.

Meanwhile, Citadel begins submitting proposals for a 1.75 million-square-foot building to serve as its headquarters in sunny Miami, Florida. The firm had previously called Chicago home but announced the move to the Sunshine State in 2022.

Do you see what I see?

Americans on the Move

There is a new migration underway in America. It began during the COVID-19 era, and it’s still happening today.

We’re seeing Americans flee areas with high costs of living, high taxes, and high regulatory burdens in favor of the sunny South.

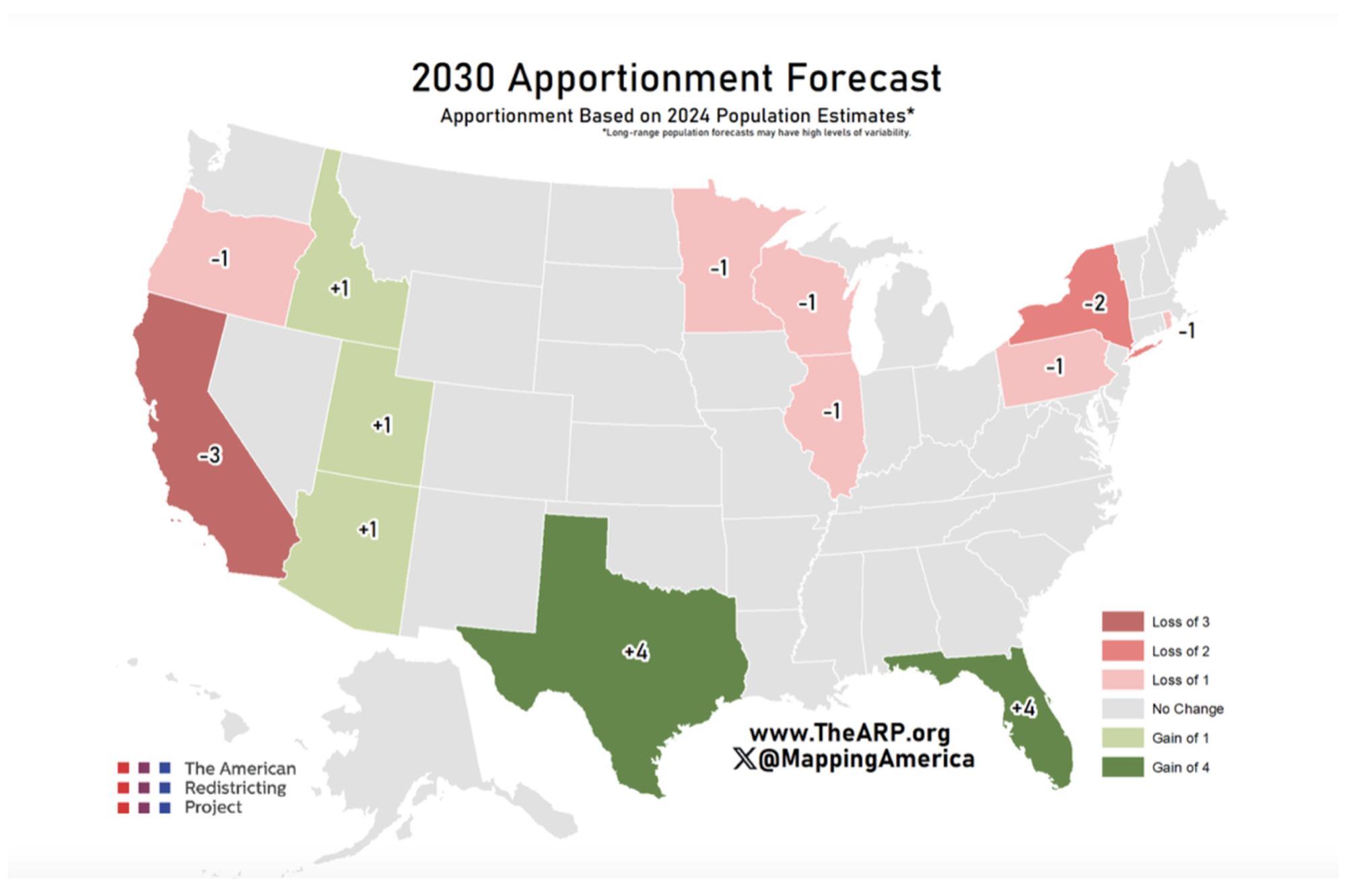

Florida and Texas appear to be the biggest winners of this trend, as made clear by recent 2030 congressional apportionment projections.

There are 435 seats in the U.S. House of Representatives, and, over time, different states gain and lose governing power and influence, based on domestic migration trends.

There are organizations that closely track migration data so that they can predict upcoming power shifts in Congress.

One of them is the Brennan Center for Justice, which published a report highlighting America’s southbound migration.

According to this report, “While southern and mountain states have continued to grow at a steady clip since the Covid-19 pandemic, the rest of the country, including one-time boom states like California, has seen mostly flat growth or even population losses.”

Researchers at the Brennan Center say that if current migration trends continue, California could lose four congressional seats, New York could lose two, Illinois could lose one, and Pennsylvania could lose one.

“By contrast,” the organization says, “the South has emerged as this decade’s growth engine, adding almost 3.9 million people and accounting for nearly all U.S. population gains since 2020.”

The American Redistricting Project agrees.

As you can see below, their research suggests that Florida and Texas are going to be the biggest beneficiaries – in terms of picking up House seats – throughout the remainder of the decade.

Source: American Redistricting Project

The most recent data from the U.S. Census is for calendar year 2023. And it shows this trend is still going strong. Once again, Florida, Texas, the Carolinas, Tennessee, Arizona, and Nevada were big gainers in terms of new residents. California, New York, Illinois, and several other northern states were big losers.

And so, the question – why?

Fortunately, data from the U.S. Census also provides us a clue.

Housing, Family Employment

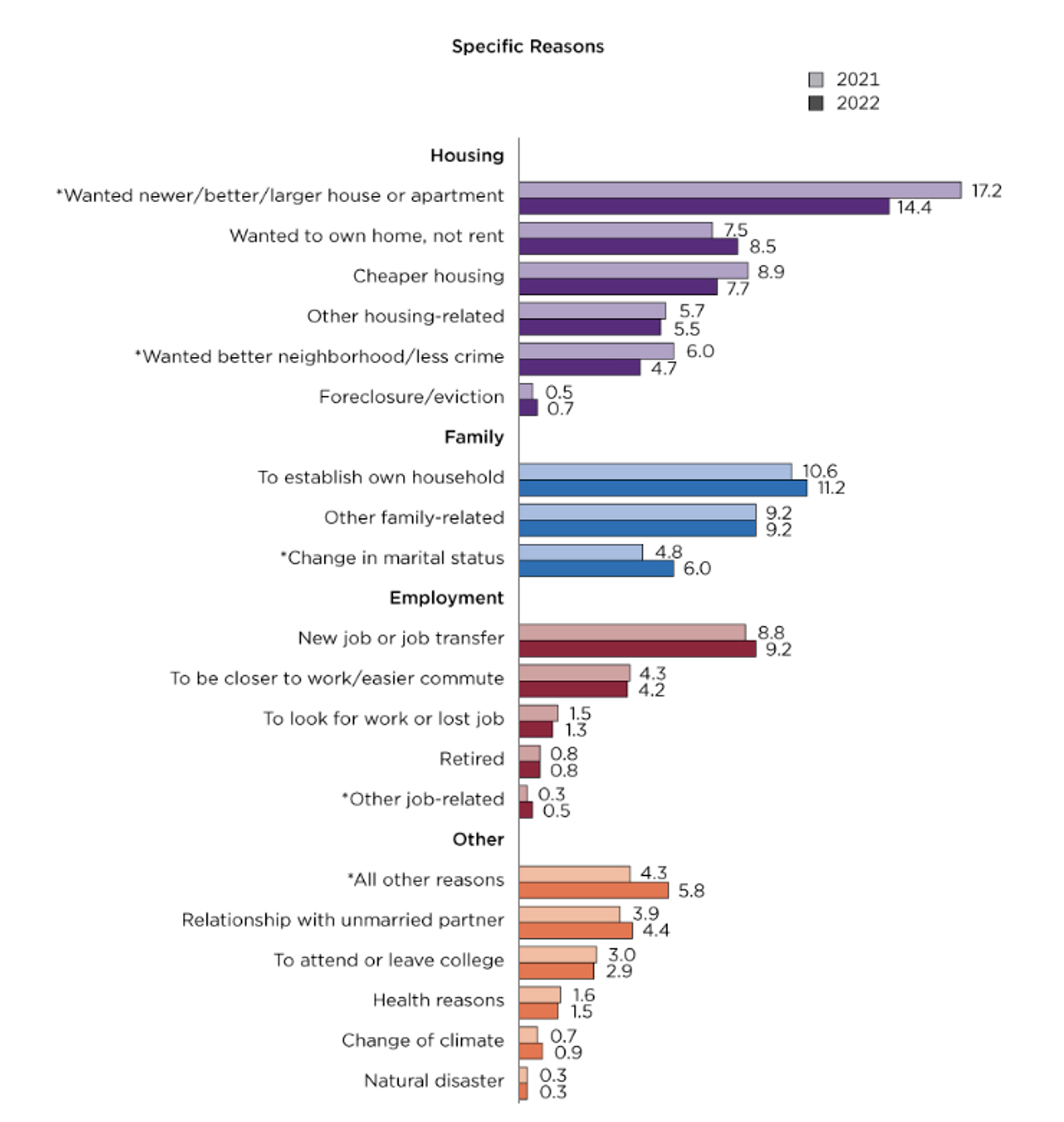

As part of its regular data releases, the U.S. Census publishes the Current Population Survey Annual and Economic Supplement (CPS ASEC). Within that report, researchers ask a simple question: Why are you moving? Sticking with the 2021-2022 timeframe mentioned above, the answers are interesting.

See for yourself:

Source: U.S. Census

What stands out to me is that for both 2021 and 2022, housing and quality of life were top priorities for those who got up and moved. More spacious, more affordable housing, in particular, was the top reason. And therein lies a big reason why this trend is not likely to reverse anytime soon.

Above, I mentioned several policies either proposed or passed in New York and Los Angeles aimed at (allegedly) lowering the cost of housing. But take it from somebody who has spent the better part of his life as a real estate developer and investor – those policies will do the complete opposite.

You cannot command the real estate market (residential or commercial) to simply lower rental rates. That’s not how it works, sorry to say. Like any market, real estate responds to incentives. And by quashing that incentive– in the form of rental caps or freezes – and the result will be less affordable housing. Full stop.

I should be clear on something…

I am not predicting that states like California or New York will collapse in the years ahead. That would be overstating it. And I’m not saying that these states aren’t beautiful areas of the country with kind and generous residents. I’m also not saying that there aren’t still some interesting opportunities for real estate investors in these areas.

What I am saying is that, as an analyst, I look for consistent growth in all aspects of our research. And when I survey many of these states where residents are fleeing, I just don’t see much.

This is why we have spent so much time analyzing real estate investment trust (“REIT”) opportunities in these growing Sun Belt markets. And for investors, this new American migration could prove to be a years-long investable trend.

Regards,

Brad Thomas

Editor, Wide Moat Daily

P.S. Not many investors have heard of Executive Order 14318. But it could prove to be one of the most pivotal actions taken by an American president in years. You see, the Trump administration is going all-in on the AI infrastructure build-out. And this executive order is part of the story. If I’m right, it will help light a fire under one corner of the market that I track closely. Get the full story right here.

|